Europe’s photo voltaic business is going through its deepest disaster in additional than a decade as steep competitors from China erodes manufacturing within the sector, rendering the continent’s hope of larger vitality independence much more wishful.

Article content material

(Bloomberg) — Europe’s photo voltaic business is going through its deepest disaster in additional than a decade as steep competitors from China erodes manufacturing within the sector, rendering the continent’s hope of larger vitality independence much more wishful.

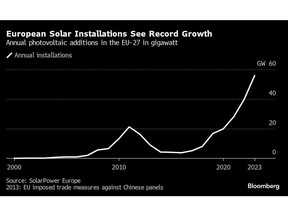

Extra photo voltaic panels had been put in than ever earlier than throughout the European Union final 12 months in a boon for the bloc’s local weather targets. Nevertheless, that was partially made potential by an inflow of Chinese language gear, inflicting earnings for native producers to plunge. Regardless of insistence to push for extra homegrown vitality infrastructure, governments have been gradual to prop up the ailing business.

Commercial 2

Article content material

Article content material

The most recent fallout turned obvious on Wednesday, when Swiss panel maker Meyer Burger Expertise AG stated it could shut a manufacturing website in Freiberg, Germany — one in all Europe’s largest — and redirect investments to the US. Pending a remaining choice subsequent month, the shutdown of the positioning could occur as early as April and would have an effect on round 500 employees.

Photo voltaic has been on the forefront of Europe’s renewables growth lately as a consequence of plummeting prices, however the development has come on the expense of European panel producers who haven’t managed to scale up provide chains sufficiently to compete globally. On the identical time, governments are below stress to push forward with the vitality transition, and lack the budgets that might be wanted to assist European producers sustain.

A key issue that difficult issues was the US’s 2022 ban on panels with parts from China’s Xinjiang area. The transfer aimed toward ruling out compelled labor, however precipitated gear to flood into Europe. Analysis agency Rystad Power estimated final July that round €7 billion price of Chinese language-made panels had piled up in European warehouses, able to producing about the identical quantity of vitality as all of the panels that had been put in within the area throughout 2022.

Article content material

Commercial 3

Article content material

Meyer Burger Chief Government Officer Gunter Erfurt known as the event “dumping.” Globally, photo voltaic module costs halved to $0.12 per watt in 2023 — a few third of Meyer Burger’s module manufacturing value, in keeping with BloombergNEF. Even main Chinese language photo voltaic producers have struggled to take care of profitability.

In September, Norway’s Norsun AS — which makes ingots and wafers utilized in photo voltaic cell manufacturing — introduced a short lived output halt and lay offs. German module producer Solarwatt GmbH stated it can minimize 10% of its workforce in November, which it had beforehand supposed to develop.

Finnish photo voltaic firm Valoe Oyj filed a debt restructuring utility in December to keep away from insolvency. Austrian PV producer Energetica Industries GmbH opened chapter proceedings that month.

“The European and German photo voltaic business is presently being massively undercut throughout the board,” stated Solarwatt’s CEO Detlef Neuhaus.

The EU has stated it goals to fabricate a minimum of 40% of its clear tech wants domestically by 2030, an ambition formed in no small half by the teachings from the vitality disaster following Russia’s invasion of Ukraine.

Commercial 4

Article content material

In the mean time, nonetheless, home suppliers meet lower than 2% of European demand for photo voltaic, in keeping with enterprise affiliation SolarPower Europe, and about 90% of parts come from China. Some producers like Meyer Burger are eyeing investments within the US after President Joe Biden’s Inflation Discount Act boosted tax cuts and incentives for finish shoppers.

The state of affairs is a grim reminder of occasions that harm Europe’s photovoltaic business a few decade in the past. Again then, the EU imposed import tariffs on Chinese language photo voltaic panels after the Asian nation ramped up industrial coverage, contributing to a steep decline in European photo voltaic deployment. Hosts of corporations closed their photo voltaic operations in Europe, comparable to Robert Bosch GmbH.

“In the present day it’s as dramatic as again then,” Solarwatt’s Neuhaus stated.

Commerce lobbies have pushed governments to ramp up assist whereas avoiding tariffs or import bans. The European Commision’s Internet Zero Business Act, which is but to be finalized, goals to set standards for renewable auctions to consider cyber-security, sustainability, and skill to ship — one thing that ought to favor home wind and photo voltaic producers.

Commercial 5

Article content material

In Germany, the federal government is debating providing producers a “resilience bonus” which might cowl the operational value variations versus their international opponents, however officers are nonetheless divided over the measure as they’ve been busy plugging a €17 billion ($18.5 billion) price range gap.

“Renewable energies are a part of essential infrastructure and we should always not develop into too depending on different international locations — particularly within the present tense international state of affairs,” stated Claudia Kemfert, an vitality professional on the DIW analysis institute in Berlin.

—With help from Agatha Cantrill, John Ainger, Priscila Azevedo Rocha and William Mathis.

Article content material

Source link